CommunityScale is leading a Housing Needs and Workforce Housing Assessment for Matteson, IL, a suburb south of Chicago with a population of about 20,000. Working with Matteson’s parcel data, we noticed many single-family homes had LLCs listed as owners – an indicator that single-family homes in Matteson were being converted to rentals, and may be owned by real estate investors.

Investor ownership of single-family homes is frequently cited as a culprit in the housing crisis. Institutional investors buying single-family homes to rent them out became widespread after the Great Recession and picked up during the COVID-19 pandemic. Critics say that corporate investors drive up prices and make it harder for locals to buy homes, while others argue that these rentals provide an entry point for lower-income families to live in the suburbs.

Large institutional investors only own about 3% of single-family housing stock in the US, but recent studies by the Lincoln Institute of Land Policy and Brookings Institute demonstrate that investor ownership is concentrated in certain markets, primarily in fast-growing Sunbelt areas like Atlanta and Phoenix. Investor ownership is clustered in neighborhoods with newer single-family homes and higher minority population shares (Ellen and Goodman 2023). There is more investor ownership in places with fewer tenant protections (Charles 2022). Studies demonstrate that investor ownership can have negative impacts for a community. Investor owners are also faster to raise rents and submit eviction filings, and more likely to get cited for code violations (Ellen and Goodman 2023, Lincoln Institute of Land Policy 2025).

Assessing Investor Ownership in a Community

Investor ownership can be hard to track. Large companies typically purchase homes under different LLC names – for example, American Homes 4 Rent may purchase homes as “AH4R IL LLC” – and without following a trail of corporate registration filings, it may not be apparent if a property is owned by a small landlord or a major investor.

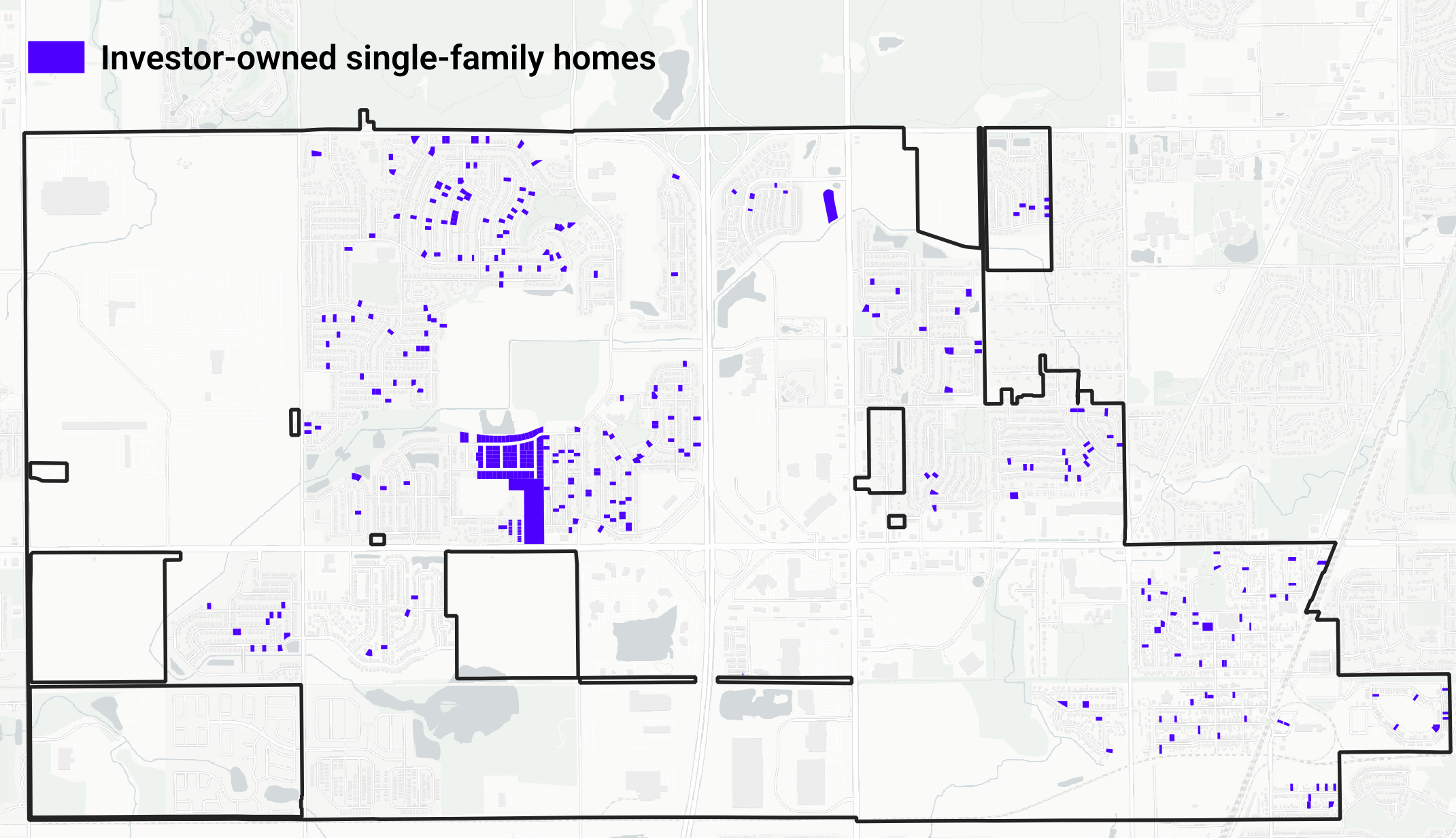

To analyze investor ownership in Matteson, we developed a python script to identify residential parcels where the property owner’s address did not match the parcel address and to find LLCs, then use fuzzy matching to group similar names and owner addresses together. Owners with less than 10 properties who have in-state addresses are more likely to be “mom and pop” small investors.

In Matteson, we identified 10 companies that own more than 10 properties. We found some of the largest corporate investors have a presence in Matteson, including First Key (53 homes), Cerberus (48 homes under 2 LLCs), and American Homes 4 Rent (10 homes under 3 different LLCs). There are also about 35 small investors who each own 4 homes or less.

Local Implications

Matteson fits the mold for a community to be targeted by large single-family home investors. The housing stock is primarily single-family homes built in the early 2000s, and the population is about 80% Black. Following the closure of the Lincoln Mall (a major employer and commercial center) in 2015, Matteson has had a high rate of vacant homes for sale.

Another factor that may draw buy-to-rent investors to Matteson is the limited rental and multifamily housing stock. Matteson has a rental vacancy rate near zero due to low supply – in 2025, there were fewer than 10 units available each month. Matteson only has about 800 multifamily units (roughly 10% of housing stock), and these are predominantly older buildings, with an average year built of 1978. No new multifamily or rental housing has been built in the last 5 years, and residential zoning is restrictive. As a result, single-family homes are filling the local need for rentals.

Policy Solutions

Communities impacted by high rates of investor ownership can take steps to better support tenants and homeowners. Creating a rental registry is a good starting point (Matteson created one in 2023), and can make it easier for municipalities to track inspections and maintenance. Other communities are enacting laws to limit the number of properties a corporate investor can own, or developing right of first refusal laws for tenants or nonprofits to have an exclusive chance to purchase a property.

Based on our study in Matteson, another strategy may be to simply encourage more multifamily units. In places like Matteson, with a lack of existing apartments and restrictive zoning that limits new multifamily construction, single-family rentals fill the gap for people who can’t afford or don’t wish to own a home. By amending zoning to make multifamily development feasible, a municipality can enable more diverse housing so single-family rentals are not the only option, lessening the appeal of these communities to large investors.